The One Big Beautiful Bill Act generated considerable attention for extending 100% bonus depreciation for new assets, but manufacturing executives should focus on a quieter provision that could prove far more transformative: Qualified Production Property (QPP).

This new section creates an entirely distinct property class eligible for immediate 100% expensing—but only for companies willing to own and build their manufacturing facilities from the ground up or acquire existing property that has not been used as a manufacturing facility since 2021.

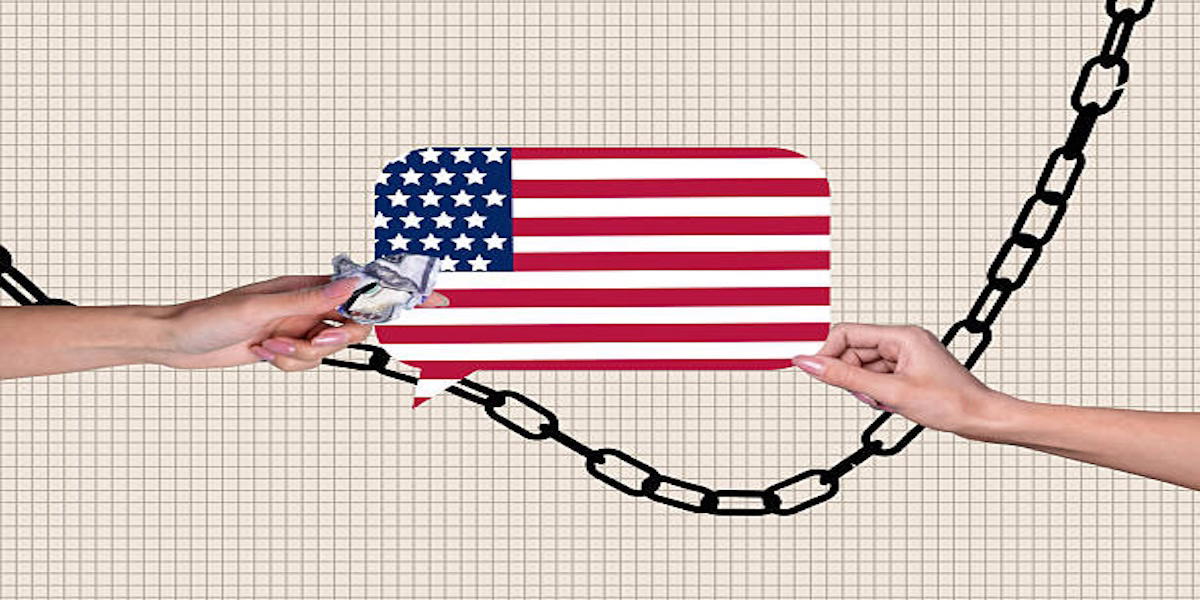

While bonus depreciation affects all qualifying personal property, QPP specifically targets manufacturing, production and refining activities with a clear message: America wants to incentivize domestic manufacturing growth, not just equipment purchases.

Read the article.